There will be more investment opportunities in commercial real estate. Demand for warehouses increases, says Lubor Svoboda from Arete

The Prague investment and real estate group Arete is a pioneer of real estate funds in the Czech Republic for so-called qualified investors, ie for people who can afford to invest a million crowns or more. This year it is launching the third specialized fund, focused on valorizing money through commercial real estate – mainly industrial and logistics parks and production facilities. Co-founder of Arete Lubor Svoboda in an interview for HN says that the economic slowdown caused by the coronavirus pandemic can reduce some property prices and create new investment opportunities. “We’re ready to buy,” he says. Growing demand for warehouses and logistics areas from online shops and other businesses also helps Arete funds . The whole article in CZ: https://archiv.ihned.cz/c7-66749690-ol906-e45489ee131143f

Speculation on profits disappears now, stability is important

“We have opened a third investment fund. Thanks to the current situation there are interesting opportunities at affordable prices in a more favourable competitive environment. Prices, which were unnaturally high in some segments, will be corrected. When the situation calms down, there will be a very good time for big investments. We are ready,” says Lubor Svoboda, co-founder of ARETE Group. Read more (Czech language version only) The coronavirus epidemic is changing the strategies of real estate investors. Instead of highly profitable projects, real estate investment funds are now primarily looking for stability, which is represented in particular by logistics and industrial properties, whose owners are now significantly less threatened by the economic impacts of the epidemic. Lubor Svoboda is one of the founders of the Arete investment funds, which specialize in investments in commercial real estate and took first place in last year’s Hospodářské noviny ranking comparing real estate funds by performance. According to Svoboda, income properties now represent the most stable investment instrument on the market. Why do you currently consider real estate to be the most suitable investment instrument? Goldman Sachs and other large banks are now recommending a shift from short-term liquid assets, which are stocks, bonds, and the like, to long-term ones, which are real estate. Investments in industrial real estate are particularly suitable, because there are a number of very high-quality companies that will not be significantly damaged by this crisis. For these companies, it is important that they generate cash, and what generates cash these days is absolutely key. Some types of real estate are currently showing great stability compared to other instruments. Are investments in commercial real estate becoming more attractive also because of the state of the stock market? For industrial real estate, two sectors need to be distinguished – logistics and manufacturing. Demand for certain logistics sectors is also growing at this time. This applies, for example, to chains that supply stores with food and other consumer goods. We see huge demand for new space in them, because they need new space due to the shift to e-commerce. Will there come a time due to the epidemic when investment opportunities arise that do not appear every year, for example in the hotel segment? Will properties that would not normally be for sale be for sale? Certainly yes, and this applies to all sectors. We have now opened a new investment fund, the third in a row, and we are very much looking forward to it. New opportunities will appear at affordable prices and there will be less competition, because some competitors will be concerned about maintaining their existing portfolios and will be more willing to sell at reasonable prices. There will be a correction in prices, which were unnaturally high in some segments and properties no longer had such a value. When the situation calms down, it will be a very good time for big purchases. What impact will the current coronavirus epidemic have on commercial properties and on investments in them? In the long term, it will certainly be felt, however, we do not see any short-term, immediate impact now. Industrial properties have the gift of not being subject to consumer behavior like, for example, retail centers or hotels, but are tied to very long-term contracts with individual tenants, which are mostly international companies that are stable enough to overcome a short-term outage. However, it is still unclear how long the current situation will last and how deep the economic downturn will be. Could industrial real estate be threatened by a possible longer production outage? It could happen. If this situation lasts longer, it is possible that individual tenants will start to reduce production. However, this does not mean that they will stop paying rent. They still have a production program and it is part of the supply-demand chain, so they have to maintain some activities. Does this not apply to shopping centers? That is the difference. Shopping centers or, for example, hotels are physically closed or have limited operations. In terms of the long-term perspective, owners of industrial real estate have much greater coverage in terms of bank guarantees or guarantees from their multinational parent companies. “There will be a correction in prices, which were unnaturally high in some segments.” For residential real estate in Prague, there is talk of the impact of the loss of rentals via Airbnb for approximately 15,000 apartments, whose owners may have problems repaying loans and mortgages. How will this affect the market? It all depends on how long this situation will last. The only thing that can be expected in the long term is some price corrections. Investors who put money into these properties will be more cautious. The question is what will happen to the returns, which were very small and essentially only depended on the speculative growth of the apartment’s value. We don’t know what will happen and whether these values will freeze. So the deeper the crisis, the more pronounced will be the differences between the individual segments of investment properties? Yes. Segments that are less resistant to crises are, for example, accommodation services, hotels, guesthouses and the like, they are the first to suffer and the declines tend to be large. We know from the last crisis that half of the pensions I have no doubt that there will be a reduction in production throughout the entire automotive industry chain. It is even possible that part of the chain will stagger and collapse completely, even if large multinational corporations survive. However, the structure of suppliers is changing greatly, and they are switching from human labor to robotics. A lot of investment is being made in the robotization of production processes, which is an irreversible process. I have no illusions that as many cars will be sold in the near future as before. A waiter who cannot work now because his restaurant has been closed will not buy a new car. Maybe in a year or two. How

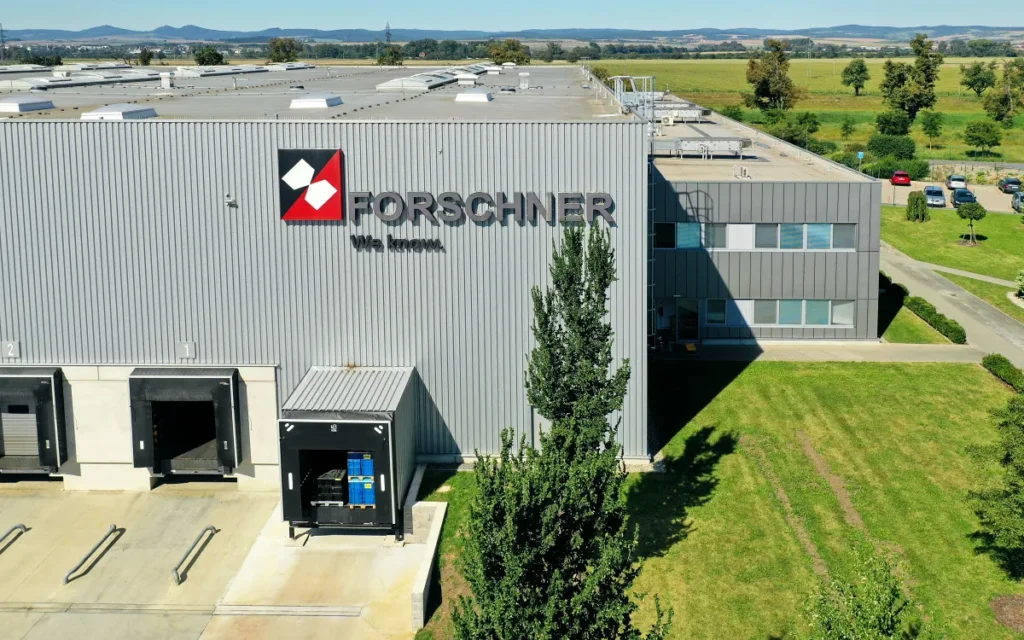

Arete widens its real estate portfolio in Uherské Hradiště and Košice, with investments reaching almost EUR 20 million

The investment and real estate group, Arete, incorporating real estate investment funds, announced today continuing enlargement of its portfolio. After acquiring land in an industrial zone lying just outside Košice, Slovakia, Arete has begun construction involving investment of EUR 13 million of a specialised production hall covering an area of 12,000 m2 for a leading European steel chimney manufacturer. Arete is also significantly enlarging the existing Forschner production hall in Uherské Hradiště, investment into this project being in the region of EUR 7 million. “After a quantity of acquisitions of functioning, profitable industrial properties that we have made over the past few years, we decided to take on our own development projects. Our pioneer project was construction of a huge warehouse on our own premises in Nové Mesto nad Vahom, which was completed last summer. Together with our current construction project, this demonstrates that we are capable of widening our portfolio, which allows us to significantly increase value for our investors,” explained Lubor Svoboda, co-founder of the Arete investment and real estate group. New Premises in Košice In November, the Arete group completed acquisition of land in the Veľká Ida industrial zone which lies within easy access to Košice in Slovakia. This zone, which even offers the opportunity of receiving government support, has for some time been the focus of interest of foreign manufacturing companies. Arete group is now building a specialised production hall for Steelcon Slovakia, part of the Danish group, Dominion Steelcon, which specialises in the manufacture of steel chimneys. This highly specialised project involving two halls with investments totalling EUR 13 million is proof of just how attractive the Slovak investment market is. Completion is planned for the second half of this year. Production hall extension in Uherské Hradiště Intensive work has been underway since last year on an extension to the existing Forschner production hall and logistics park in Uherské Hradiště. The new hall extension should be finished in April. An important aspect of the construction work is the creation of modern, clean production spaces suitable for manufacturing components for electric cars while meeting the highest international standards, with a constant temperature and humidity. Of course, rainwater infiltration and heat recuperation considerations are also addressed in the construction works. Modern office space and hygiene facilities for staff are integral to the new hall. Class A industrial premises in Uherské Hradiště with excellent road access to Slovakia and South Moravia has been in the Arete portfolio for four years now and it is 100% leased out to Forschner, which has grown from a German family firm into a multi-national corporation. Its focus lies on electric vehicles, production of cable and electromechanical systems and other components intended mainly for the automotive industry. Its clients include Audi, Continental, Daimler, Volkswagen, Philips and Bosch. About the Arete Group: The investment and real estate group Arete was established in 2014 and focuses on investment in real estate. The first Arete Invest sub-fund, which focused on residential properties, completed its investment cycle in 2017, with a gross total appreciation of 120%. The second Arete Invest sub-fund, investing in industrial properties, has been operating since 2016, with a gross total appreciation of more than 90%. In 2020 a third fund has been opened for investors: Arete Industrial. The goal of this new fund is not simply investment in ready-built industrial properties, but also to construct them. The funds are intended exclusively for qualified investors, both natural and legal persons, whose activities are subject to inspection and supervision by the Czech National Bank. For more information, go to www.arete.eu. Find out more by phoning: Ondřej Micka, mobile: +420 724 352 552 Martina Chromečková, mobile: +420 774 135 551 Tel: + 420 251 091 211 E-mail: arete-pr@emcgroup.cz

Arete investment group opening its third real estate fund to follow on from the success of the two preceding funds

The Arete investment and real estate group today announced the opening of now its third qualified investor fund, based in the Czech Republic and operating under the supervision of the Czech National Bank. This third fund is to follow on from the successful history of the preceding funds, with the first fund having been closed three years ago and investors paid off with a total gross appreciation of 120%, while the second fund has fulfilled its strategy with its current gross appreciation of over 90%. The new Arete fund will both invest into completed industrial real estate in Central and Eastern Europe and also itself construct new logistics and manufacturing buildings. Its portfolio target value should approach EUR 500 million during the anticipated six-year investment cycle. “After six years of operation of the Arete group, we can be proud of the successes we have achieved. We significantly appreciated the funds invested in the first fund within a very short time, and succeeded in formally closing it, something quite exceptional in the Czech market. We subsequently focused all our energy on the second fund, focused on industrial real estate, and this is continuously achieving above-standard results. We believe that our third fund will follow on from these successes,“ stated Lubor Svoboda, one of the two Arete group co-founders. “In spite of the slowing of industrial growth in the Czech Republic and the short-term volatility of the stock markets, the overall economic situation in Central Europe is conducive to the further development of logistics and manufacturing. Hence the investment strategy underpinning our new fund once again focuses precisely in this direction. Through combining an aggressive investment strategy into already existing revenue-generating industrial real estate with the construction of new sites, we want to follow on from our historical performance in this next fund. More and more investors consider investment in funds focusing purely on industrial real estate to be a far more profitable alternative to unsecured corporate bonds, and so interest in this type of investment is significantly growing. The attractiveness of this type of asset in the Czech Republic and Slovak Republic is also demonstrated by the severalfold greater interest from global players and investment groups,” added Robert Ides, the second Arete group co-founder. The third Arete group fund is to focus on industrial real estate with stable yields in combination with construction, specifically of class-A logistics and manufacturing real estate in Central and Eastern Europe. The anticipated investment horizon is six years. The portfolio target value should approach CZK 12 billion and the portfolio should include over 600 000 m2 of leasable area and over 300 000 m2 of building land for further construction. The new fund was formally established last year, but new investor entry is only commencing now. The investment cycle of the first Arete fund culminated at the end of 2016 with the sale of the whole residential portfolio, made up of several hundred apartments, to a foreign financial investor. The financial and legal closing process for this fund was completed in early 2017, and it was one of the first ever successfully closed funds in the Czech Republic. The fund achieved gross appreciation of 120% over the two years of active management. The second Arete fund was established in 2016, and gradually built up a homogenous portfolio of industrial real estate. Its objective is to continuously appreciate the invested funds of its investors at over 11% per year, while the actual rate of return far exceeds this announced value. The most recent, unaudited results for 2019 show total gross appreciation of over 90%. The entry of investors into this fund was closed in 2018.

New Arete real estate group fund to purchase and construct warehousing space worth billions

The domestic Arete group is launching its third real estate fund. It is planning the purchase of warehousing space and industrial halls in both the Czech Republic and throughout Central and Eastern Europe. It will also be launching its own developer projects for the first time. The portfolio target value should approach CZK 12 billion. “In spite of the slowing of industrial growth in the Czech Republic and the short-term volatility of the stock markets, the overall economic situation in Central Europe is conducive to the further development of logistics and manufacturing. Hence the investment strategy underpinning our new fund once again focuses precisely in this direction,” stated Arete co-founder Robert Ides.The new fund will be targeted at private and institutional investors. The minimum investment is to be EUR 200 000 (CZK 5 000 000). The first investors have already placed tens of millions of euros into the fund. Arete is also anticipating the use of bank loans of approximately the same amount as the total volume of own funds.Specialists in commercial real estate say that the new fund’s strategy and focus make sense. “The market has sufficient reserves of both capital and demand from both foreign and domestic investors for this type of real estate. If we leave aside the acquisition of any already existing larger portfolio, the indicated volume can only be invested in several countries at once, and so the focus on the Central and Eastern Europe region is a logical one,” commented Alexander Rafajlovič of the investment team at the consultants Cushman & Wakefield.The new fund plans with a six-year investment cycle. Its ambition is to accumulate 600 000 square metres of halls for leasing and 300 000 square metres of land for further construction. Arete’s Ides anticipates the completion of the initial acquisitions this summer.“Considering last year’s construction of almost four million square metres in the Central and Eastern Europe region, the ambition of 600 000 square metres is definitely possible,” said Ferdinand Hlobil, responsible for international industrial transactions at Cushman & Wakefield.The investment cycle for the second fund is currently coming to an end in the Arete group. It has appreciated investors’ capital by 90 percent since its opening in 2016. This second fund manages 125 000 metres of leasable space in the Czech Republic and Slovak Republic, including the international logistics headquarters of the C&A clothing chain.According to information on the E15.cz server, Arete is currently finalising negotiations for the sale of this portfolio to the American investment giant CBRE Global Investors. Neither Arete nor CBRE GI have commented on this information.The industrial real estate market is very active. The German Garbe Industrial Real Estate has announced its entry into the Central and Eastern Europe market. This company has constructed halls for Amazon in Germany, for example. Star Capital is one of the new Czech players to begin constructing industrial halls.More at https://www.e15.cz/byznys/reality-a-stavebnictvi/novy-fond-realitni-skupiny-arete-bude-nakupovat-a-stavet-sklady-za-miliardy-1367431

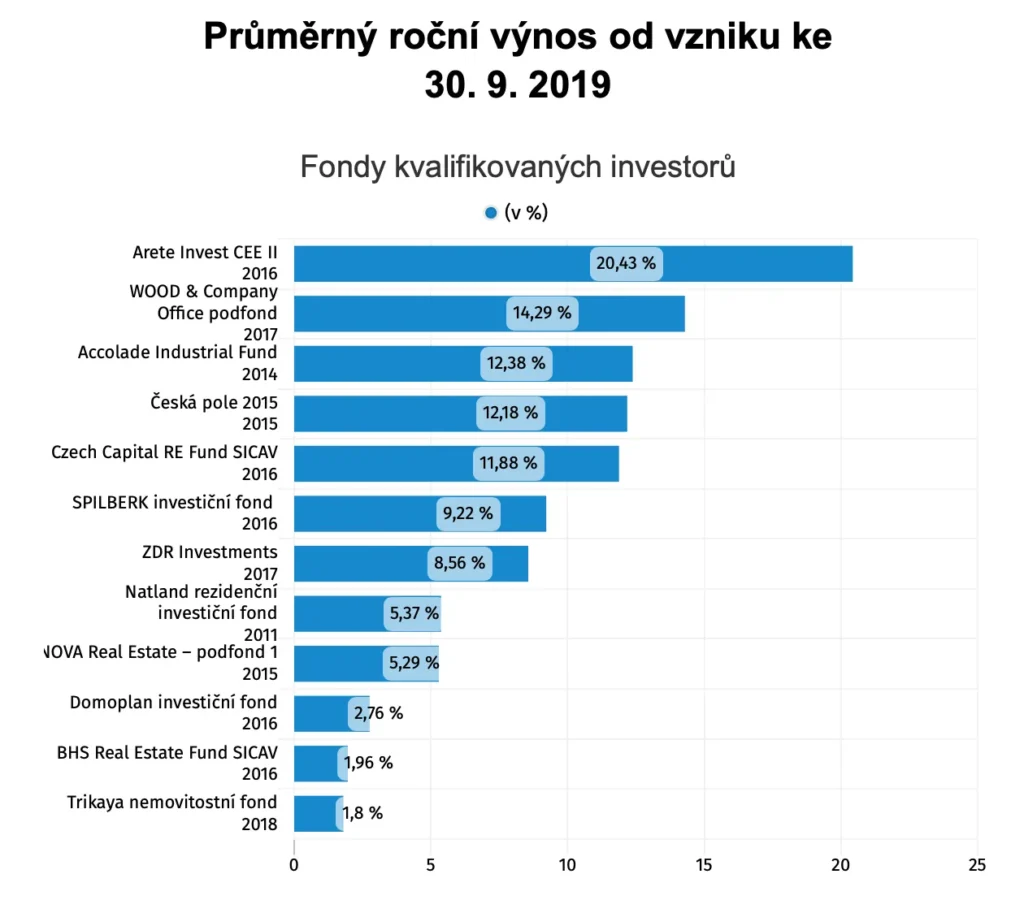

Results HN – 3Q2019

The fund of the Arete Group is the most profitable real estate fund in the Czech Republic. According to independent statistics of Hospodářské noviny monitoring data of real estate funds operating in the Czech Republic, the fund of the Arete Group has long brought the highest appreciation to its investors. The sub-fund CEE II of Arete Invest reigns supreme in the overall long-term statistics – it has both the highest average annual return throughout the fund’s existence (20.43 %) and the highest average annual return over the last three years (25 %). At the same time, the sub-fund CEE II has one of the lowest loan-to-asset ratios out of all the monitored funds of qualified investors with loans. This is based on data from the web portal Investujme – a joint project of Hospodářské noviny and the Institute for Strategic Investments at the University of Economics in Prague. Since 2017, it provides an overview of data on all types of real estate funds available to Czech investors. The newly released data processed financial information valid at the end of the third quarter of 2019. An overview of all independent evaluation results is available on the website: www.ihned.cz/investujme.

The Arete Group, in cooperation with Deloitte, organized a professional conference on the topic of Investment Portfolio Creation

The professional conference aimed to familiarize participants with a comprehensive view of the investment portfolio and the representation of individual instruments in the investment portfolio with a focus on real estate. The speakers then tried to practically outline which investment instruments are suitable for investors in relation to the length of the investment cycle and the investor’s relationship to risk. Miroslav Svoboda, Managing Partner of Deloitte, placed particular emphasis on examples of individual investment instruments from independent advisors, on the assessment of the type of investment, tax and legal jurisdiction and, last but not least, on the importance of the underlying asset of the investment. Robert Ides, co-founder of the Arete investment group, introduced participants to a basic comparison of the performance and liquidity of selected investment funds from developed European countries and Central and Eastern European countries. He focused primarily on the evaluation of the investment, the liquidity of the funds and the relationship of these indicators to the economic development in the given countries. He concluded the lecture by stating that deciding to invest in real estate funds represents an interesting investment alternative that should not be missing in any investment portfolio, while it is important to understand the fund’s investment strategy, the method of calculating the value of shares and the geographical exposure of the portfolio from a macroeconomic perspective on the given countries. Miroslav Linhart, partner at Deloitte, presented the most important trends in the real estate and construction market in the Czech Republic and Europe. The key questions here were the characteristics of individual markets, their specifics, as well as current trends and risks that can be expected in the coming years. In the panel discussion, the speakers tried to predict future developments in connection with the challenges that continental Europe is currently facing (monetary policy, migration waves, global competitiveness, etc.).

Arete Group starts construction of a new manufacturing hall for leading european manufacturer of steel chimneys near Košice

At the beginning of November, Arete Epsilon SK, member of real-estate investment group Arete, completed acquisition of land plots in an industrial park in Veľká Ida at the border of Košice city, a regional capital of East Slovakia region. This industrial park allowing investors to draw governmental subsidies has been very appealing to international manufacturing companies long term. The Arete group has started construction of the new production hall for the Danish company Steelcon Slovakia shortly after the acquisition. It should start production of steel industrial chimneys mainly for export during the second half of 2020. This highly customized production hall worth almost 13 million EUR confirms attractiveness of Slovak investment market. After completion of the hall, Arete group will expand its presence on the Slovak market and will grow its portfolio of production and logistic properties to 125,600 sqm in total. „Steelcon Slovakia is a very reputable and stable partner to us, who understands Slovak market benefits and considers its decision to stay in the region for at least next 15 years as very strategic,“ says Tomáš Novotný responsible for strategic development and asset management within Arete group.

Fashion e-shop will get a new warehouse in western Slovakia

The new warehouse will provide 60,000 square metres on several levels. The Czech investment fund Arete Invest, focusing on investment in real estate, is building a new warehouse for the international chain of fashion e-shops Factcool in the industrial park at Nové Mesto nad Váhom. “The Slovak market is an advantageous investment destination for our fund and our investors,” said Lubor Svoboda, co-founder and chairman of the administrative board of Arete Invest, as cited by the SITA newswire, adding that the investors are expecting upper standard yields. https://spectator.sme.sk/c/20905939/fashion-e-shop-will-get-a-new-warehouse-in-western-slovakia.html

Arete Invest Is Expanding A Hall For Forschner In Uherské Hradiště

the Arete investment group, which includes the newly established Arete Industrial fund, has commenced construction work to expand the existing production hall by approx. 4200 m2in the industrial and logistics park in Uherské Hradiště. “With this development in Uherské Hradiště we are fulfilling our strategy to broaden this site on the expansion lands we have had since the start of the acquisition,” comments Lubor Svoboda, co-founder of the Arete group, adding: “This will provide us with another modern hall which is being built according to the latest technological and environmental standards, which will enable the tenant to maintain the high standard of its production process, optimise operating costs and improve its economic results.” The new hall should be completed at the turn of the first and second quarter of 2020. The project includes, amongst other things, the construction of modern clean operations for the manufacture of components for electric vehicles in accordance with the strictest international standards, covering an area of approx. 680 m2, including LED lighting, with constant temperature and humidity. The construction project naturally includes rainwater infiltration and air recovery. Other integral parts of the hall include modern office and sanitary facilities for employees. The expansion for Forschner will cover a total area of 4 300 m2. The Class A industrial complex in Uherské Hradiště with its excellent transport links to Slovakia and south Moravia has been part of the Arete Invest portfolio for three years now and its 100% leased by Forschner, which has grown from a German family firm to become a multinational company. It specialises in electromobility, the production of cable and electromechanical systems and other components intended especially for the automotive industry. Its clients include Audi, Continental, Daimler, Volkswagen, Philips and Bosch.