The construction of industrial real estate increased by a record number in the first half of 2020

The main sectors that dominated the demand for industrial and warehouse space during the coronavirus pandemic with a total share of 53% are logistics companies and large e-shops, whose services rose sharply in the second quarter. This was followed by manufacturing companies with 37 percent. Logistics leased 62% of new premises and production 28%. Lubor Svoboda, co-founder of the ARETE Group, which invests in industrial real estate through its funds, adds market data: “During the coronavirus pandemic, our funds saw increased demand for storage from large logistics companies and the e-commerce segment. Due to the stability of the industrial real estate segment, our group is preparing several acquisitions of larger industrial parks. I think that in the second half of the year the transactions of interesting investment volumes will take place.” The article in Czech is available here: https://retrend.cz/novinky/vystavba-a-remodeling/vystavba-nemovitosti/

The ARETE group is strengthening its logistic premises and has attracted new lessees in the Czech Republic and Slovakia

Despite the Coronavirus crisis, the ARETE investment and real estate group has managed to fill vacant areas on its premises and extend contracts with lessees in recent months. In Nové Mesto nad Váhom, ARETE has prepared more than 7 thousand m2 of premises for TPL, a logistic company, intended primarily for food storage. CTE Cargo sped, a sea and air carrier, moved back to the premises in Lovosice, which cover an area of4.3 thousand m2 and the contract with Fiege, a company providing reverse logistics for the Zalando fashion brand, has been extended for eight years. The occupancy rate of all ARETE's premises is therefore now 100 %. The contract with Fiege concerning ARETE’s premises in Lovosice was extended in April for a total of eight years. Fiege provides reverse logistics with added value to the Zalando fashion brand, using a total of 3.4 thousand m2. In the first quarter, CTE Cargo sped, a company specialising in sea and air cargo, operating in ARETE Park Lovosice. The company has signed a contract for 4.3 thousand m2 of storage space for at least three years. The occupancy rate of the premises in Lovosice is therefore now 100 %. At the same time, investments were made to increase the standards of the entire complex. TPL moved to ARETE Park Nové Mesto nad Váhom to use more than 7,000 m2 on the basis of a long-term contract. The company specializes in comprehensive logistics services, including co-packing. The new highly energy-efficient premises have been tailored to TPL’s specific needs in order to meet the high standards of food storage, distribution and logistics, i.e. the focus of TPL’s logistics services. The premises have obtained all the necessary certifications and attestations and meet all the stringent hygienic standards. The premises also include an office building for the management of logistics operations. “We are glad that we have managed to find a suitable solution for TPL and their distribution warehouse that meets the client’s requirements and allows the client to ensure full and efficient operation within Slovakia,” said Igor Šnirc, director of the Slovak branch of the ARETE group. “We appreciate their highly professional approach. We believe that they will be satisfied with the new premises and that ARETE will be the right and reliable partner for their development,” he added. “We consider the contract for the new warehouse premises, which are part of ARETE Park Nové Mesto nad Váhom, to be a strategic investment in Slovakia. ARETE’s assistance with customization as well as the low energy performance of the premises create a fundamental building block for an efficient, modern and environmentally-friendly central logistics solution for our clients. Moreover, the warehouse premises also include high-quality facilities for our employees,” said Ľuboš Korec, CEO of TPL Slovakia, s.r.o. Both complexes where the above-mentioned changes have been made are part of the portfolio of the second ARETE fund established in 2016. Its total accumulated gross yield soared to 115 % in 2019. This fund was closed to new investors in 2018. However, the third fund of the ARETE group was opened to investors at the beginning of 2020. This fund will not only invest in completed industrial real estate in Central and Eastern Europe but will also construct new logistic and production buildings. The target value of its portfolio should be close to CZK 12 billion and the portfolio should include over 600,000 m2 of leasable premises and more than 300,000 m2 of building land for further construction.

The Czech investment and real estate group ARETE is entering the Slovak, German and Austrian markets

The ARETE investment and real estate group has successfully passed the notification process in Slovakia, Germany and Austria. In these countries, it can now actively offer entry in its third ARETE INDUSTRIAL fund, opened this year. Slovak, German and Austrian investors should have a share of up to 50%. This fund invests in completed industrial properties in Central and Eastern Europe, but will also build new logistics and production buildings itself. In Slovakia, the ARETE Group already owns and develops a number of properties in Žilina, Nové Mesto nad Váhom and Košice with a total value of over EUR 50 million. For more information in Czech, please read: https://www.estate.cz/lifestyle/ceska-investicni-a-nemovitostni-skupina-arete-vstupuje-na-slovensky-nemecky-a-rakousky-trh

The ARETE Czech investment and real estate group is entering the Slovak, German, and Austrian markets

The ARETE investment and real estate group has successfully completed the notification process in Slovakia, Germany, and Austria. In these countries, it can now actively offer entry to foreign investors to its third fund, ARETE INDUSTRIAL, opened this year. Slovak, German, and Austrian investors should thus have a share of up to 50% in it. This fund invests in completed industrial real estate in Central and Eastern Europe, but will also build new logistics and manufacturing buildings itself. In Slovakia, the ARETE group already owns and develops a range of real estate in Žilina, Nové Mesto nad Váhom, and Košice with a total value of over EUR 50 million. “We consider the Slovak market, in particular, to be very promising. We already have a range of real estate in our portfolio there, as well as our own team and office. Gaining the possibility to actively offer to investors thus represents a logical step in the development of our ARETE group. Slovakia, Germany, and Austria have great potential, and we have already verified that there is demand for investing in our fund in these countries,” said Lubor Svoboda, ARETE group co-founder . “We want to be an international fund working through international standards and with an international investor portfolio. We plan that Slovakia, Germany, and Austria will provide up to 50% of the investors in our fund,” adds Robert Ides, the other ARETE group co-founder. “Although we are also considering opportunities in other Central European countries, we want to continue to buy real estate in particular in the Czech Republic and Slovakia,” he adds. Obtaining all the necessary permits took about two months in total, and required a number of legislative conditions to be met. Investors from countries outside the Czech Republic were already able to enter ARETE funds on their own initiative, but now ARETE can actively address investors from these countries. This activity on foreign markets then falls under the responsibility of the national financial market regulators. The third ARETE group fund, which was the subject of the notification process, has been open to investors since the start of this year. It will invest in completed industrial real estate in Central and Eastern Europe, but will also build new logistics and manufacturing buildings itself. The target value of its portfolio should be close to CZK 12 billion, and the portfolio should include over 600,000 m2 of leasable areas and more than 300,000 m2 of building land for further construction.

Arete invests up to 80 million euros in industrial real estate in the CEE region

The Arete investment and real estate group has signed a loan agreement with Raiffeisenbank for up to EUR 80 million. The funds will be used to refinance the existing real estate portfolio of the second fund (Arete Invest), and as an investment in the new construction of industrial real estate. The original article in Czech, including the comments of the fund's founders, can be found here: https://skypaper.cz/novinky/arete-investuje-az-80-milionu-eur-do-prumyslovych-nemovitosti-v-regionu-cee/

ARETE group successfully refinances its fund portfolio during the pandemic and now has a bank loan of up to EUR 80 million available

Prague, 3rd June 2020 – On 30th April, the ARETE investment and real estate group signed a contract with Raiffeisenbank for a loan of up to EUR 80 million. The funds will be used to refinance the existing real estate portfolio of ARETE’s second fund (ARETE INVEST CEE II sub-fund) and to invest into new industrial real estate construction while preserving a safe ratio of bank financing to fund asset value. For ARETE’s second fund this ratio is currently 43%, one of the lowest of all the qualified investor funds on the market. “Our real estate portfolio is high quality, with high value and profitability. The provided credit line of EUR 80 million shows that our fund is stable and resilient even in the current situation when the provision of new loans by banks is stagnating – the confidence shown in us by Raiffeisen is definite proof of that. Financing with such an amount at a time like this is really an exceptional success,” said Lubor Svoboda, ARETE group co-founder. “The funding brings our fund high stability and the certainty of sufficient capital backing. Yet it also brings new potential for portfolio growth, as the loan will be used flexibly based on our actual needs. This will allow us to take advantage of new opportunities on the market. At the same time, we want to keep the bank loan to asset value ratio at a safe level. It is at times like these that our strategy of lower indebtedness proves to be an unequivocal competitive advantage,” adds Robert Ides, the other ARETE group co-founder. The preparations for the refinancing and provision of a new credit line took a few months and the final agreement was made on 30 April. The goals of the newly signed contract were to simplify the administrative load arising from the eleven separate existing loans, and to enable higher flexibility for the funding of new construction. The legal aspects of the entire transaction were supervised by experienced law firms – Kocián Šolc Balaštík for ARETE and Clifford Chance for the bank. The second ARETE fund was established in 2016 and is gradually building up a homogeneous portfolio of industrial real estate in the Czech Republic and Slovakia. The total cumulative gross return for 2019 reached 115%, while the gross return for the previous year was 8.9%. The value of the managed assets at the end of 2019 exceeded CZK 2.4 billion and will grow further in 2020 thanks to halls currently being completed. This fund was closed for the entry of new investors in 2018. A third ARETE group fund opened for investors at the beginning of 2020 that will not only invest into completed industrial real estate in Central and Eastern Europe but also itself construct new logistics and manufacturing buildings. The portfolio target value should come close to CZK 12 billion, and the portfolio should include over 600,000 m2 of leasable area and over 300,000 m2 of building land for further construction.

How has coronavirus affected real estate demand?

Nemovitostní trh pocítil první dopady celosvětové pandemie. Velmi se ale liší podle typu nemovitosti – nejvíce jsou koronavirovou krizí ovlivněny hotely a maloobchodní prostory, naopak nejméně průmyslové a logistické nemovitosti. Jak rychle se podaří vše dostat do stavu ze začátku roku bude záviset nejen na uvolňování restrikcí u nás a v zahraničí, ale i na struktuře vlastnictví příslušných nemovitostí. U logistických objektů je znatelný dopad nárůstu e-commerce, u těch průmyslových je pak ve střednědobém horizontu možný i strategický přesun části výroby z Asie zpět do Evropy. I to vyplývá ze závěrů odborné on-line konference o realitním trhu v současné době, kterou společně v první polovině května uspořádaly investiční a nemovitostní skupina ARETE a poradenská společnost JLL. Celý článek zde: www.estate.cz/lifestyle/jak-koronavirus-ovlivnil-poptavku-po-nemovitostech

Experts say coronavirus has changed demand for certain real estate

The real estate market has felt the first effects of the global pandemic. Yet not all segments are seeing the same changes – hotels and retail premises have been hit hardest, while industrial and logistics buildings have been spared the worst. How quickly everything returns to the normal situation from the beginning of the year will depend on the easing of restrictions domestically and abroad, and also on the ownership structure of the relevant real estate. Logistics buildings are seeing an increase in e-commerce and the owners of industrial real estate may move some production back to Europe from Asia as a new medium-term strategy. This is the conclusion of an expert on-line conference on the current real estate market jointly held in the first half of May by the investment and real estate group ARETE and the real estate consultants JLL. “Investments have obviously slowed due to the coronavirus – when people cannot meet, transactions are suspended. However, we expect this direct impact to be reversed within the next six months at most. Compared to real estate investment horizons, this is actually a very short time,” says Hana Kollmannová, director of capital funds at the JLL real estate consultants. “Keep in mind that certain countries are still seeing a lot of transactions. In Germany, for example, pension funds have purchased real estate at prices higher than those six months ago,” says Robert Ides, co-founder of the ARETE investment and real estate group. The rates of return from real estate have remained at the same level, except for retail buildings and hotels – these two segments have been hit hardest by the pandemic. We are not seeing such drastic impacts in other segments. The general problem on the Czech market is a lack of industrial real estate suitable for investment. “We expect investors to focus on long-term leasing of real estate to solvent tenants. We believe that the industrial real estate segment will return to normal first, including the volume of transactions, while hotels will probably be last,” says Hana Kollmannová from JLL. Compared to 2018, last year we saw a lot of interest from Czech investors in offices and hotels, but less in industrial real estate. This could change significantly. We are now witnessing a trend of leasing industrial real estate to e-commerce companies. The immediate demand for warehousing and distribution centres is strong. “We can expect the manufacturing segment to follow the same path over the long term – companies will be considering a strategic move from Asia to Europe over the medium- and long-term to reduce and stabilize their distribution networks. The current situation has clearly shown that a number of companies have suspended production because of a lack of parts and components produced outside the European Union, not due to the restrictions,” explains Robert Ides from ARETE. Generally speaking, we assume that the value of industrial real estate will rise, in particular in the Czech Republic. The value of industrial real estate in Europe has grown between 12% and 31% in the last five years. Central Europe has seen the least growth – only 15% in the Czech Republic. “Global demand is continuously increasing and will continue to do so in the future because of the growth of the global population. Consumer behaviour cannot be changed at will – goods must be produced and stored somewhere. The coronavirus has just shifted consumption over time,” explains Robert Ides from ARETE. The average rent for industrial real estate in the Czech Republic stabilized at EUR 4.75 per m2 per month at the end of the last year. “Currently, at the end of Q1 2020, the industrial real estate vacancy rate has risen slightly from 4.1% to 5.3%, but this is still far from the levels seen between 2008 and 2011. We think this is a mere fluctuation. If the restrictions are successfully eased, we expect a decrease in the vacancy rate due to the low level of speculative construction,” adds Hana Kollmannová from JLL. The ownership structure of the real estate and owner behaviour will probably be the key factors. There is a big difference between the current crisis and the one from 2008. Back then, German funds represented a large part of real estate. However, Czech capital has gained a larger share over the years. “We can clearly see the influence of market demand in exchange-traded funds. Investors may quickly close their positions and force the funds to sell a part of their portfolio. This could introduce interesting opportunities for profitable transactions to the market. Non-publicly traded funds are not exposed to the effects of financial markets – the only thing that matters is the independent valuation of assets. So far we have not seen any differences in valuation, nothing has changed. The new valuation will become clear after transactions have been affected,” says Robert Ides from ARETE. The change in the banking sector policy has definitely been important. “The ratio of bank financing to fund asset value will play an important role. Less indebtedness is currently a major advantage,” says Robert Ides from Arete.

Earnings results of ARETE real estate fund: Cumulative return of 115%, year-on-year appreciation of 8.9%

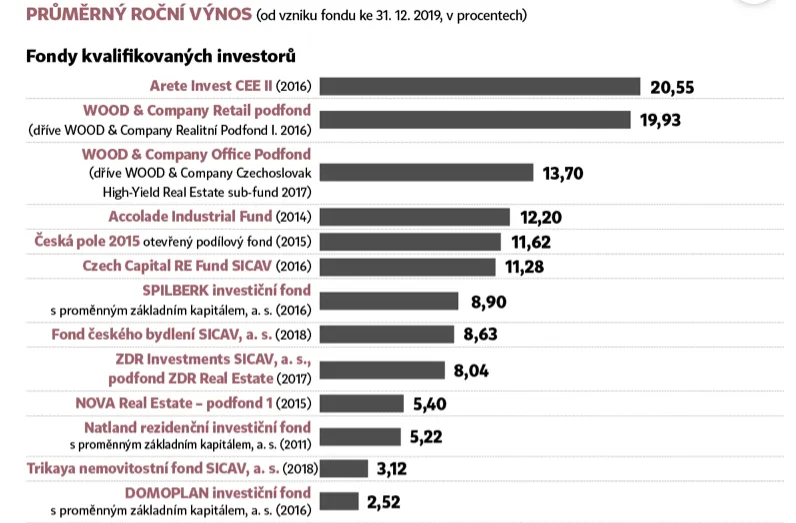

Today, the ARETE investment and real estate group released information about the earnings of its second fund in 2019. The total cumulative gross return on the fund, focused on investment into industrial real estate in the Czech Republic and Slovakia, reached 115%, while the gross return for the previous year was 8.9%. The value of assets at the end of 2019 exceeded CZK 2.4 billion and the fund will grow further in 2020 thanks to its halls nearing completion. A detailed inspection of the results is now being finalized by the auditors of Deloitte Audit. This year, ARETE group opened up a third fund to qualified investors. In addition to industrial real estate, this fund also invests in new construction. “The past year was very successful for us. After four years of operation on the Czech and Slovak market, the second fund has achieved considerable success – we managed to increase the assets in our portfolio and further diversify it and maintain extraordinary returns for our investors,” said Lubor Svoboda, one of the co-founders of the ARETE group. “In the coming years, we want to keep bringing exceptional returns to our investors. And since the second fund was closed last year to new investors, we focused on preparing a completely new, third fund. We opened it to investors this year and we have already seen investments worth tens of millions of EUR. A significant advantage of the new fund is the option to purchase under better market conditions, which can significantly increase the value of investments in the coming years.” Robert Ides, the other co-founder of the ARETE group, says, “We have data from an independent evaluation of the earnings from our real estate funds in the Czech Republic as of 31 December 2019. Our ARETE group fund is earning our investors the highest appreciation over the long run.” The ARETE INVEST CEE II sub-fund lords over the overall long-term statistics – it has had the highest average annual return for the whole term of its existence (20.55%). At the same time, it has one of the lowest ratios of bank loans to assets among all the evaluated funds of qualified investors. “At this time, we think our strategy of lower indebtedness, which has been applied in our new fund, is an unequivocal competitive advantage for us,” says Robert Ides. In 2020, a third fund of the ARETE group opened up to investors. This fund is not only going to invest in developed industrial real estate in Central and Eastern Europe but will also build new logistics and manufacturing buildings. The target value of the portfolio should approach CZK 12 billion and it includes over 600,000 m2 of premises for rent and more than 300,000 m2 of lots for further construction. “At this point, our investment evaluation in the Czech Republic and Slovakia includes real estate totaling more than CZK 8 billion. We consider some of them to be very interesting,” adds Lubor Svoboda.

The fund of the ARETE Group is the most profitable real estate fund in the Czech Republic

According to independent evaluation of Hospodářské noviny monitoring data of real estate funds operating in the Czech Republic, the fund of the ARETE Group has long brought the highest appreciation to its investors. The ARETE INVEST CEE II sub-fund reigns supreme in the overall long-term statistics – it has the highest average annual return throughout the fund's existence (20.55 %). At the same time, the sub-fund CEE II has one of the lowest loan-to-asset ratios out of all the monitored funds of qualified investors with loans. It results from the common project of HN and the Institute for Strategic Investments at the University of Economics, Prague. Since 2017, it provides an overview of data on real estate funds available to Czech investors. Newly published data processed financial information valid at the end of 2019. In addition, this year, as part of its growth and thanks to the interest of investors, the ARETE Group has opened a new fund of qualified investors, ARETE INDUSTRIAL SICAV, which focuses on industrial properties in the CEE region.